Bing returns over 9 million results to the query, “is now a good time to buy a house?” Ask Google, and you’ll see over 10 billion results! Homebuyers can easily find “advice” online. But wouldn’t you rather have prospective homebuyers in your market reach out to you instead of Bing or Google?

It’s an especially important question in tough market conditions. That’s when prospective homebuyers may be even more vulnerable to common myths that may mislead them to hold off on their dream of homeownership. As they compete for homes in a low inventory environment and rush to put in offers that are thousands of dollars above asking price, buyers need someone they can trust to help them navigate the ever-evolving housing market.

That someone should be you

Having the right information ready can open the door to viable options prospective borrowers might not otherwise discover. For LOs who are always in prospecting and networking mode, you never know when a seemingly simple question could create a great opportunity. It’s a good idea to plan your approach to answer common borrower questions like these:

- Which type of mortgage is best for me?

- How much of a down payment will I need?

- Do I qualify for down payment assistance?

- Will I have to pay mortgage insurance?

- What interest rate should I expect?

Build trust, gain credibility and earn more business

When you provide clear and accurate answers to borrowers’ questions, it not only satisfies their immediate needs, but it also creates a positive ripple effect that can lead to referrals in the future. You build trust, gain credibility and ultimately turn those borrowers into advocates who’ll recommend your services to family, friends and colleagues.

How to be prepared for success

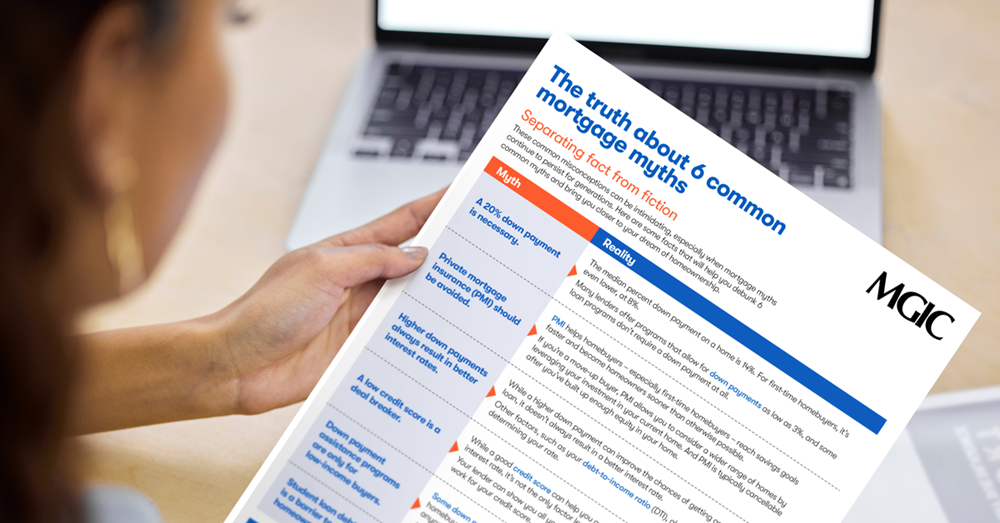

Resources like The Truth About 6 Common Mortgage Myths: Separating Fact from Fiction are designed to put stats and proof points at your fingertips. Keep this “cheat sheet” handy to debunk some of the most persistent myths today’s prospective borrowers believe:

- A 20% down payment is necessary.

- Private mortgage insurance (PMI) should be avoided.

- Higher down payments always result in better interest rates.

- A low credit score is a deal breaker.

- Down payment assistance programs are only for low-income buyers.

- Student loan debt is a barrier to homeownership.

You can boost your efficiency by keeping a “toolkit” of informative resources on hand. For example, our first-time homebuyer resource library houses a variety of materials – from financial readiness and credit to budgeting and the mortgage process – designed to help you educate and guide your borrowers through their homebuying journey. All are available in English and Spanish, ready to download and print or share via email and social media.

A slow market can be a harsh reminder that establishing strong client relationships begins by empowering them with knowledge (and confidence!). Well-educated borrowers are more likely to refer friends and family and return to you for future needs, contributing to your long-term success!

"