Mortgage Connects

The Hispanic community is an untapped opportunity for the housing market

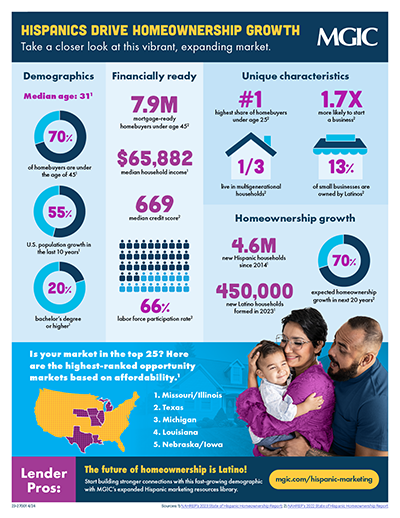

According to the National Association of Hispanic Real Estate Professionals (NAHREP), Hispanics drove 97.5% of U.S. population growth in the last 3 years. Younger than the general population, with a strong desire for homeownership, Hispanics are a key demographic that should not be overlooked. By considering their unique strengths and qualities, you can position yourself to better serve this burgeoning market and foster mutually beneficial relationships.

Download our infographic to delve into why Hispanics make viable homeowners and how you can leverage this opportunity to expand your lending portfolio.

Get access to our Hispanic homebuyer resources

Tap into our library of resources to understand, guide and reach the fastest-growing homebuying demographic – and earn new business and referrals. Includes educational materials in English and Spanish, research and data, industry insights and more.