Mortgage Connects

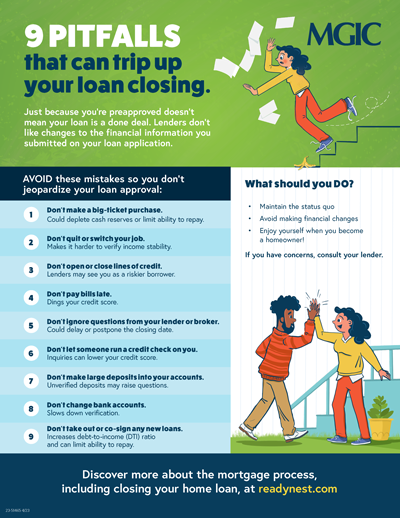

9 pitfalls that can trip up your loan closing

Help borrowers avoid jeopardizing their loan approval

Nearly 1 in 4 home purchase contracts are delayed. Delayed closings can be disappointing and costly, but they are preventable. Many borrowers have no idea that certain actions can jeopardize the closing of their mortgage loan. Consider these stats*:

- 22% of home purchase contracts are delayed but ultimately close

- 5% of contracts are terminated due to buyers being unable to obtain financing

- 73% of home purchase contracts settle on time

An educational tool for your borrowers and real estate partners: Use this infographic to help your borrowers understand the many reasons mortgages fall through at closing and what actions to avoid doing while waiting for their mortgage loan to close. Take advantage of our ready-made loan closing pitfalls social shareable to easily share this infographic with your social media followers.

*According to the National Association of REALTORS®

Download English Download Spanish

It’s easy to share with your followers

From readynest.com, you’re just a click away from getting this infographic in front of your Twitter, Facebook and LinkedIn followers. Here’s how:

- Click on this link: 9 pitfalls that can trip up your loan closing | Readynest

- Click on the social media platform icon

- Add a message and click “Post” to publish

Here’s a ready-made message you can cut and paste:

Did you know that nearly 1 in 4 home purchase contracts are delayed? Discover the pitfalls to avoid during the mortgage process to help ensure your loan is approved on time.